How I Turned Zero Experience into $15,000/Month Trading Success…

…And Built the Freedom to Live Life on My Terms.

From Pressure Washing to Trading Full-Time. Discover the Life-Changing Method That Can Get You Funded and Profitable Without Risking Your Own Capital.

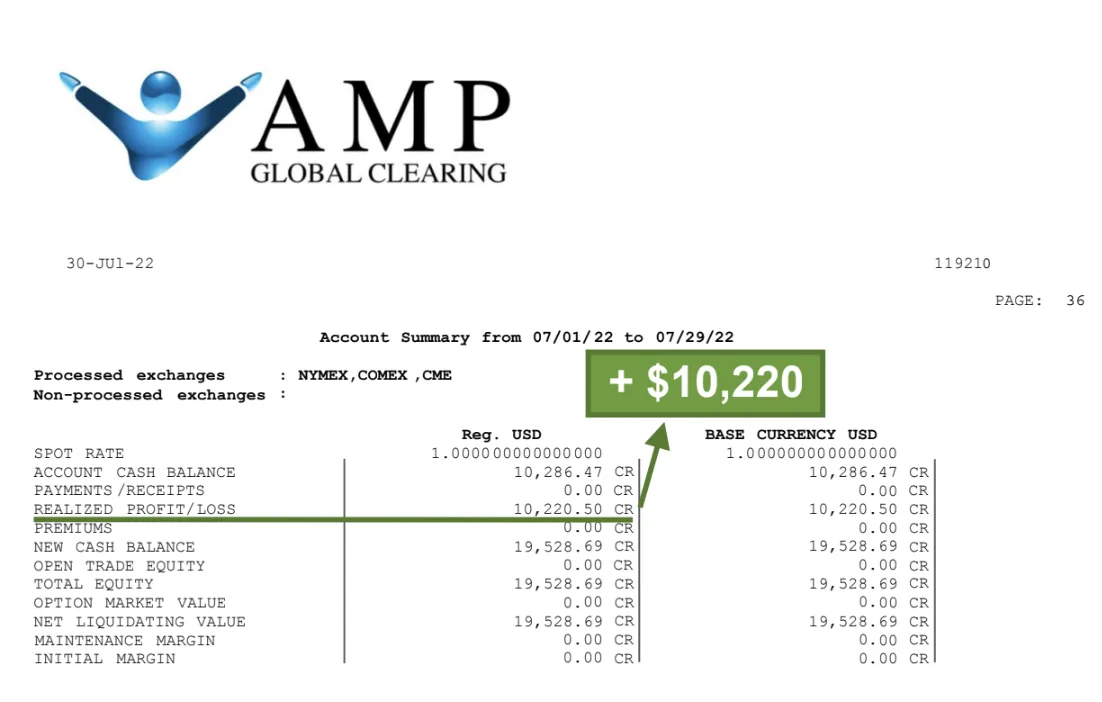

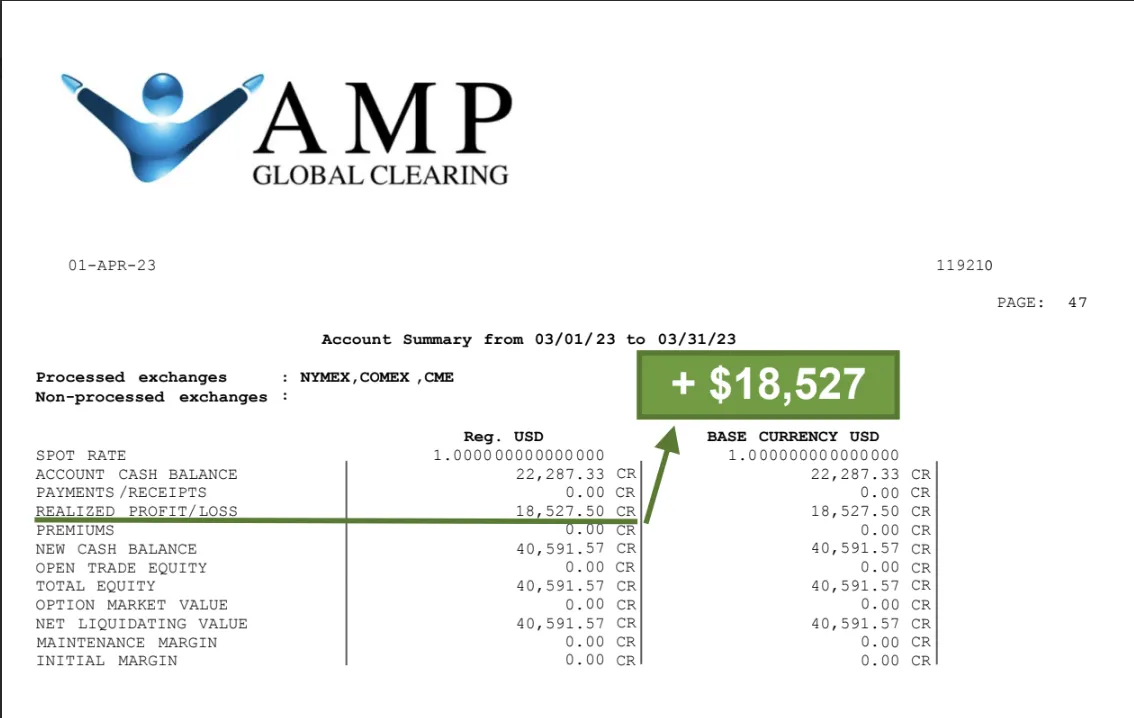

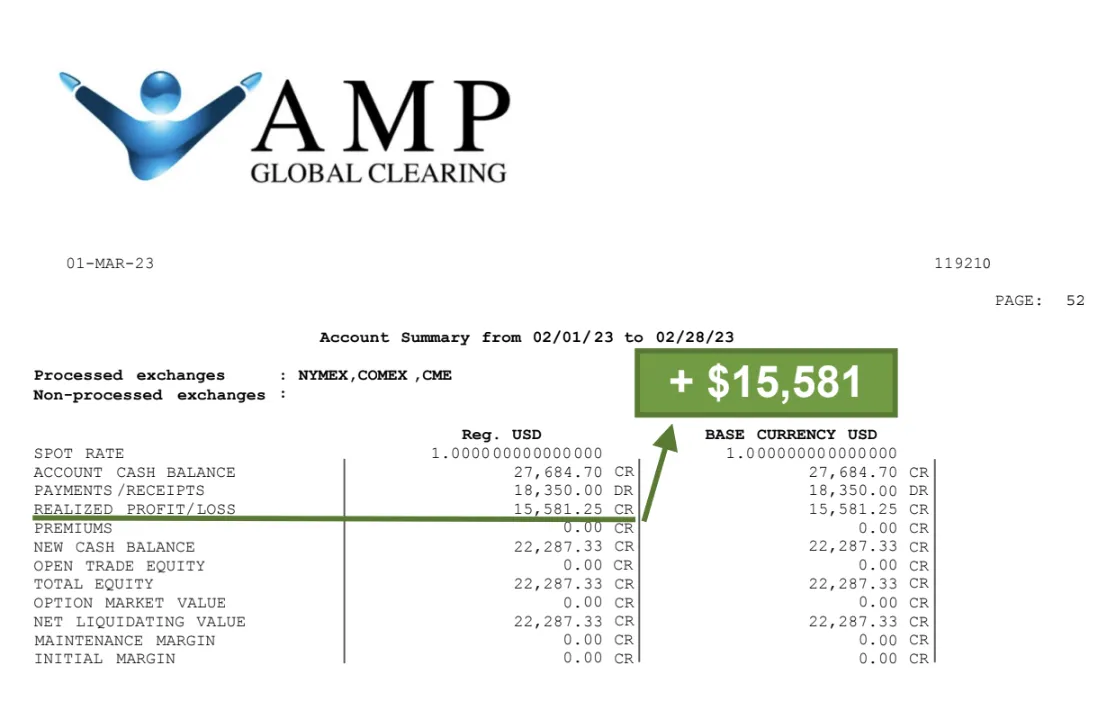

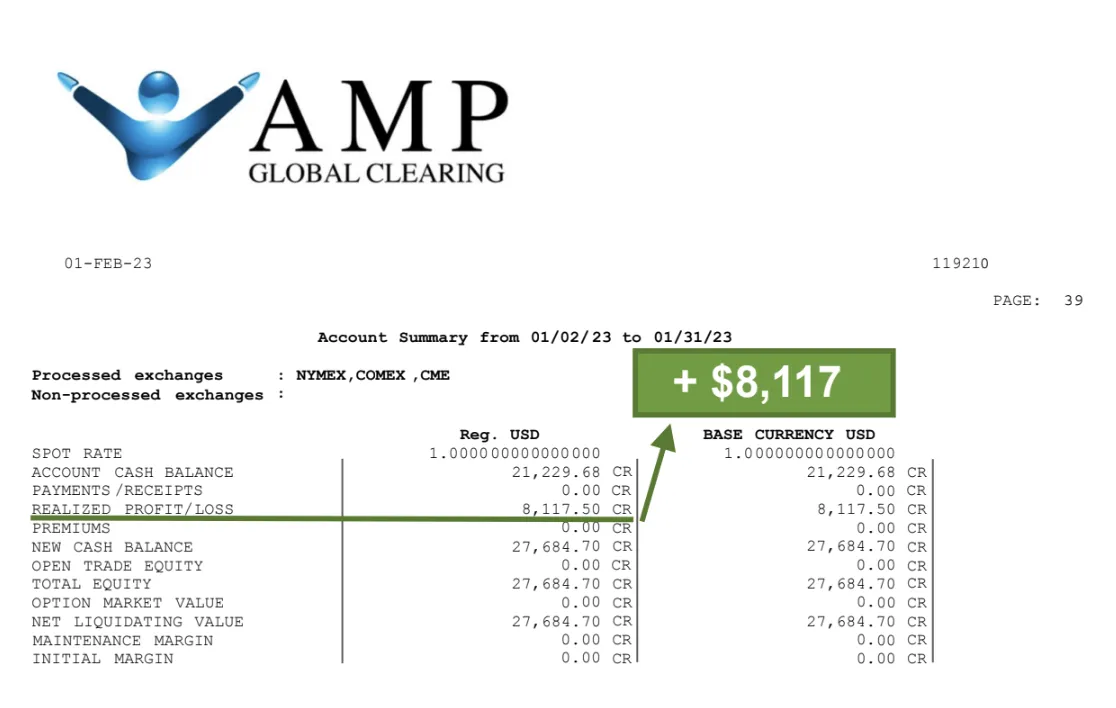

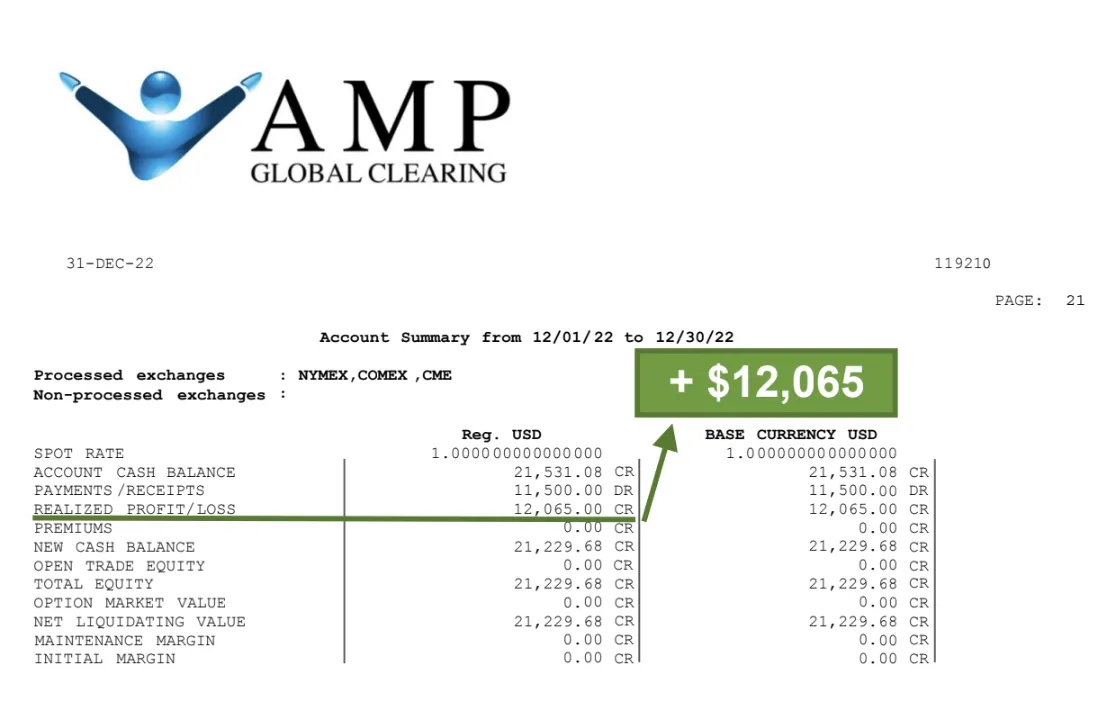

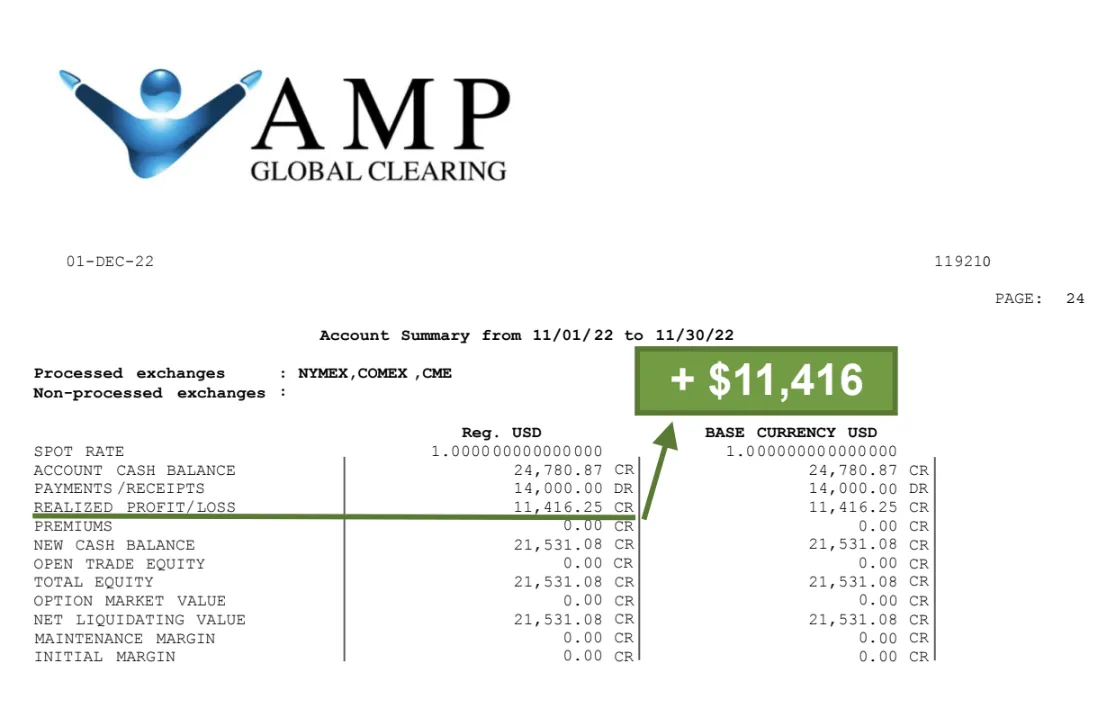

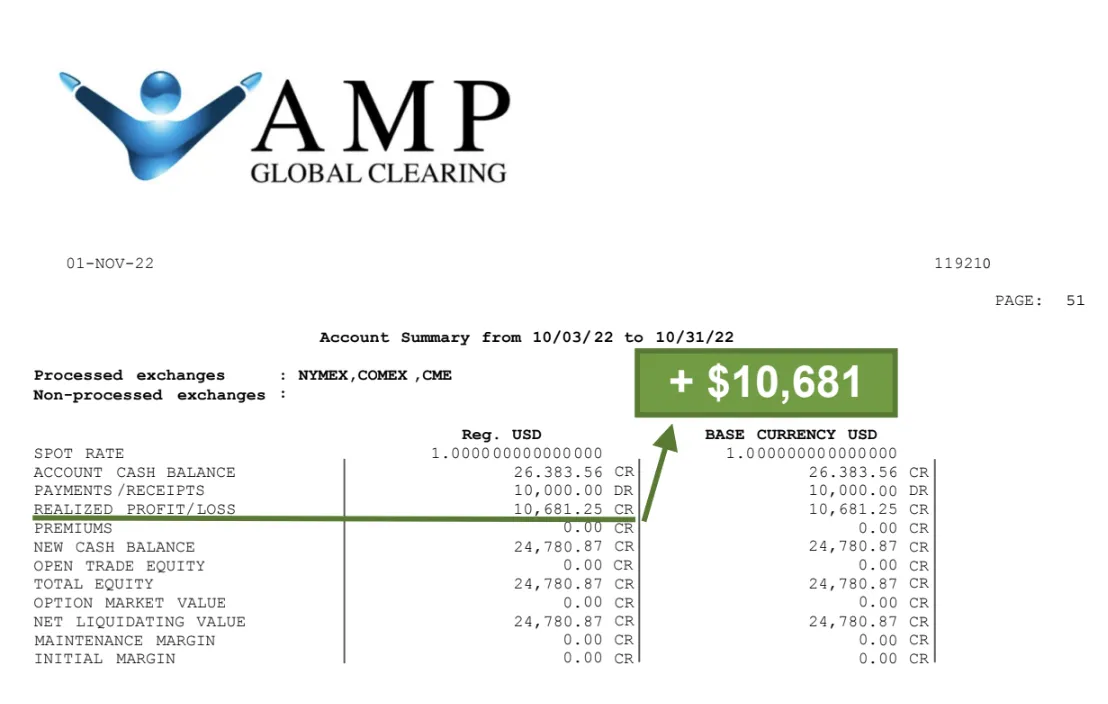

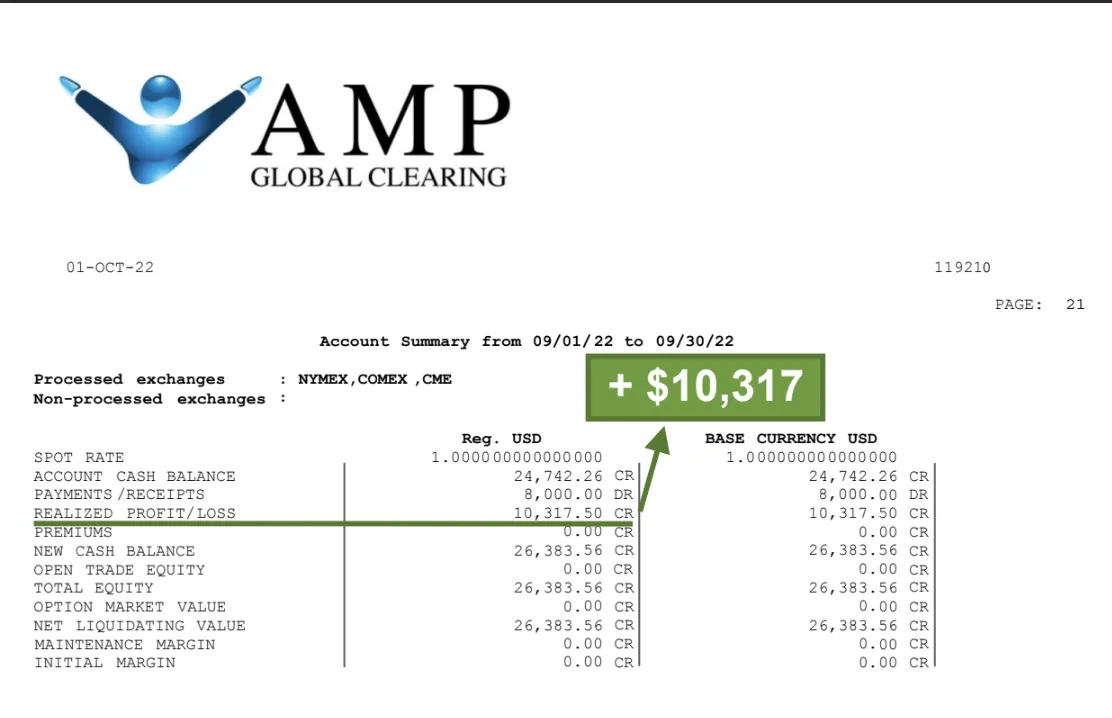

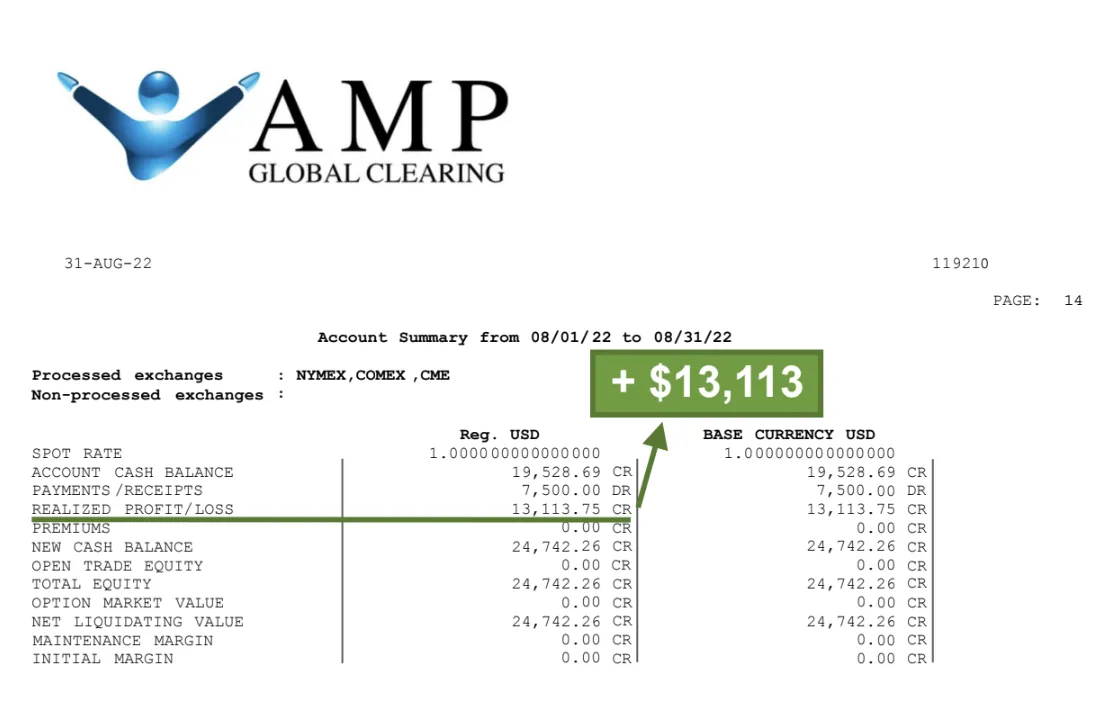

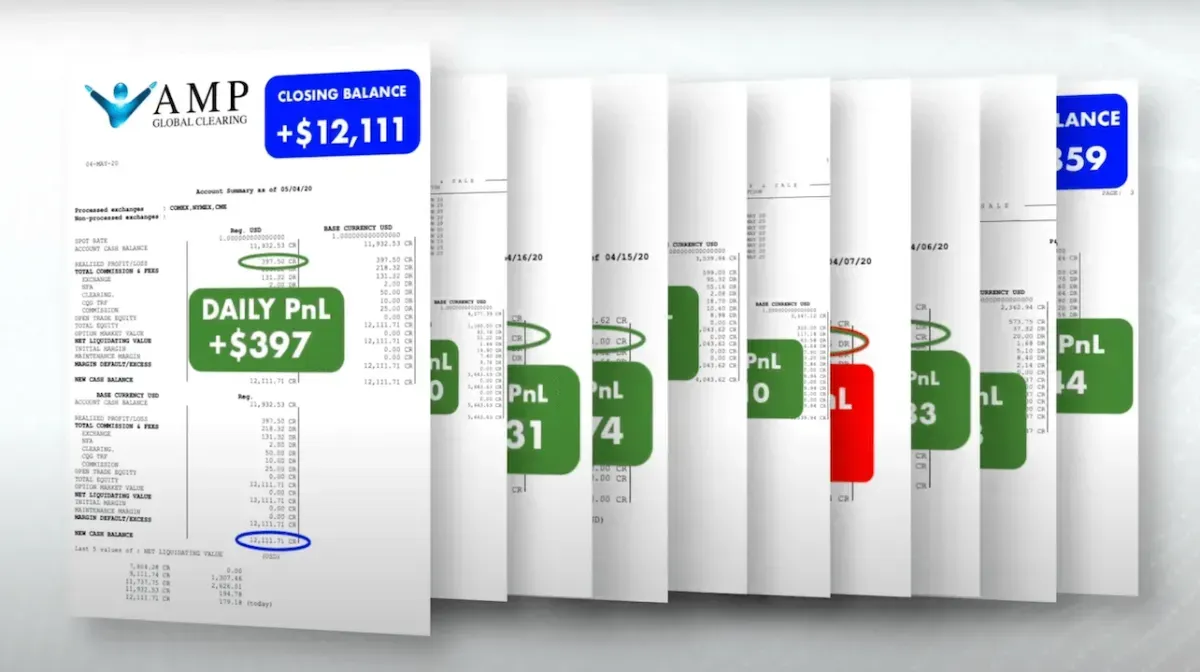

Some of our students' results

From the Desk of Aaron Korbs

Currently trading while traveling the world...

January, 2026

Hi, I'm Aaron Korbs!

Born in a cult, no high-school diploma, from nowhere Arkansas.

Not the best setup by most peoples’ standards.

Spoiler-alert: Definitely not a Wall Street guy.

Blue-collar worker, pressure washing windows in my local town, trying to make ends meet. Scraped together my first $10,000, put it into trading, thought it was my ticket to freedom.

Lost every penny of it.

Later learned I could get funded with institutional capital. Burnt over 109 funded accounts. This is where most people would have quit. And to be clear, I could have convinced myself to do the same. But I didn’t.

I hated how I was living. Forced to stay at my parents' basement because I couldn't afford to rent a place on my own. I wasn’t living at all.

Waking up to an alarm that always seemed to ring out in the best part of my sleep, stumbling to my car half asleep to slave away at something I had no passion for.

Barely any time to spend with the people I love who brought me joy. Not taking care of my health the way I wanted.

Each day I despised what my life had become more and more. I had grown to feel like the game of life was rigged against me.

But I still knew there were people that came from nothing just like me, out there living a life of freedom for themselves and their loved ones.

I was determined to get a piece of it.

So I peeled back the onion and got to the root of what I was doing wrong.

To be clear, peeling this onion took me two years, countless sleepless nights, and over $30,000 in debt, mostly paid to gurus making empty promises. But in those empty promises was the truth I was looking for.

The truth is that most retail traders fail, and they fail hard. But why?

On the cusp of failure myself, what I learned changed my life forever. Most of us fail at trading not because of the market but simply because

we’ve been taught to pay attention to the wrong things.

During one of my final late-night browsing sessions, barely able to keep my eyes open after a full day of manual labor in my pressure washing “business,” I found an intriguing tool that had been used by hedge funds on Wall Street.

They claimed it was the reason these hedge funds are known for beating the market no matter what’s happening in the world. I was skeptical, but as I dug deeper, it finally clicked.

Enter, The Volume Profile.

The only trading strategy that looks at real-time information and not past information trying to predict the future.

At my fingertips, I now had a tool that empowered me to finally explain why I was winning and why I had been losing all this time! I felt like a blind man regaining sight.

Because of this, I could now learn from my mistakes with pinpoint accuracy. No longer just a guess or more trial and error that had already cost me many thousands.

I found I could now manage my trading account like the business I always wanted it to be while actually knowing how much money I would make in a given month.

No guessing, no wishing, no hoping. All those feelings disappeared.

I no longer needed them.

The feeling was liberating.

I finally felt in control.

I finally felt empowered when I lost a trade because I knew why and how not to repeat my mistake twice.

I finally felt deserving of my wins because, again, I knew why.

I was now able to replicate my wins and, of course, confident to grow them bigger.

Fast forward to today, as I’m writing this to you now, reminiscing on this

crazy journey, I am certain that whether I am in the Unites States or Mexico or Thailand, I will average $10,000-15,000/month any given year year.

I’m also certain that after my 2-4 hours trading session, I’ll still have time to do what I’m truly passionate about these days, which is no longer just trading, but seeing more of this beautiful world we live in, places I had never heard of growing up in nowhere USA.

But also seeing the look in my students’ eyes when they finally have their own lightbulb moment in trading that changes their life and family’s life forever just like it did mine.

If you’ve read this far, chances are you’re something like me.

You know there’s more for you in this life, and you’re determined to go out there and grab it.

If my story hits home like it has for so many of our students, book a time to speak with me or my team below, and we’ll see if we can possibly help fast-track you to a life of freedom with trading.

Sincerely,

Aaron Korbs

FAQ

Who is Aaron Korbs?

Aaron Korbs is a full-time professional futures trader with over 8 years of experience, specializing in the Volume Profile. He’s one of the few traders who shares his results publicly — consistently earning $10k–$15k per month. His mission is to teach others how to build a consistent, scalable trading business, even from scratch.

What's the opportunity here?

We help everyday people become funded, profitable traders — without risking their own capital. Whether you’re starting from zero or looking to improve your edge, our programs give you the tools, training, and support to build a real trading business.

How is Tradacc different from other trading programs?

We don’t rely on outdated indicators or theory-heavy content. We teach real institutional tools like Volume Profile, order flow, and auction market theory. More importantly, we combine that with live trading, daily setups, and 1-on-1 coaching to make sure you actually apply what you learn — and get results.

Can I succeed at this even if I'm starting from zero?

Absolutely. Many of our most successful students started from zero — some didn’t even know what a futures contract was. Our training walks you through everything step-by-step, and as long as you show up ready to learn, we’ll help you get results.

Can I do this part-time?

Yes, you absolutely can. Many of our students start while working full-time jobs or balancing other responsibilities. Korbs trades just 2–4 hours a day himself — it’s all about having a focused system, not sitting at the screen all day. If you can commit a few consistent hours each week, you’re in a great spot to succeed.

Do I need a lot of money to get started?

Not at all. You don’t need a big trading account to get started with our method — and even if you have one, we actually don’t recommend using it right away. Instead, we teach you how to start in simulation mode, build your edge, and get funded by a Prop Firm so you can trade with institutional capital. This not only protects your own money, but helps you prove that you’ve developed real skill before risking anything. “Institutional capital” means you’re trading with firm-provided funds based on your performance, and keeping a share of the profits.

This is the same approach most of our students use to earn their first payouts — without the pressure of putting personal capital on the line.

What’s a realistic timeline to become a consistent trader?

Everyone learns at a different pace, but with our structured roadmap, some students become consistently profitable within a few months. If you stay consistent and follow the steps — like completing SIM trades and working with your coach — you could see real results in 3–6 months. A more conservative pace is 6–12 months if you’re going slower or balancing it with other commitments.

What type of trading do you teach?

We teach short-term intraday trading — meaning trades are opened and closed during regular U.S. market hours, with no overnight risk. We focus on the S&P 500 Futures (ES), trading between 9:30 AM and 4:00 PM EST. This style is perfect for people who want consistent income potential while managing risk and avoiding the stress of holding trades overnight.

Which markets/products do you trade?

We trade Futures — specifically the S&P 500 Futures (ES minis and micros), though not limited to just that. These markets offer high liquidity, strong leverage, and the ability to profit in both rising and falling markets. They’re ideal for traders who want fast execution and capital efficiency.

Do you offer live training? Can I trade along with Korbs?

Yes! You’ll get access to live Zoom calls with Korbs, where you can watch his trades in real-time, ask questions, and get direct feedback. Plus, you’ll receive his daily trade ideas, and our accountability coaches are there to guide you and keep you on track — so you have all the tools you need to succeed.

What is the Volume Profile Formula course?

The Volume Profile Formula is our entry-level course that teaches the core foundations of the Volume Profile — the same tool Korbs and our funded traders use daily. It’s perfect for beginners who want to understand how the market really moves without relying on outdated retail indicators. You can check it out here.

What is the Funding Accelerator program?

The Funding Accelerator is a step-by-step program focused on helping you get funded through prop firms as quickly and efficiently as possible. It teaches a single, simplified strategy based on VWAP, designed to help you pass an evaluation and secure capital — without needing multiple setups or advanced training. To see if it’s a fit, book a call with our team here.

What is the Profile Method program?

The Profile Method is our most advanced coaching program. It gives you a full playbook of professional trading setups using Volume Profile, plus live Zoom calls with Korbs, daily trade ideas, and 1-on-1 coaching. It’s designed to help you become a consistently profitable trader, get funded, and generate payouts. Pricing depends on the level of support you want. To learn more, book a free Breakthrough Call here.

How much do your programs cost?

Our programs are custom-tailored based on where you’re at in your trading journey and how much support you’re looking for — so pricing isn’t one-size-fits-all. We also don’t offer spots in our coaching programs to just anyone. You need to qualify first to make sure it’s a good fit for both sides. That’s why we start with a free Breakthrough Call — it’s your chance to connect with our team, talk through your goals, and explore what makes the most sense for you. 👉 Book Your Free Breakthrough Call here.

What results have your students achieved?

Many of our students have successfully passed prop firm evaluations, secured funding between $50K and $300K, and even received their first payouts — often within a few months of starting. We’re proud of the real results our traders are getting. 👉 Click here to see real testimonials and student wins

What kind of support do I get inside your programs?

The support you get depends on which program you join and the level of guidance you’re looking for. Depending on your path, you could get access to step-by-step on-demand training, daily trade ideas and market breakdowns, live Zoom sessions with Korbs, and even one-on-one coaching — including the opportunity to work directly with Korbs himself.

You’ll also be matched with a personal accountability coach and get access to a private community of like-minded traders. That’s why the best first step is to book a Breakthrough Call.

We’ll take a look at your goals, experience level, and schedule — and recommend the program that gives you the structure and support you need to succeed.

Risk Disclosure: Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure: Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Live Trade Room Disclosure: This presentation is for educational purposes only and the opinions expressed are those of the presenter only. All trades presented should be considered hypothetical and should not be expected to be replicated in a live trading account.

Testimonial Disclosure: Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.